Corporate groups minimize their tax burden by setting up intermediary companies in countries with low corporate taxes. Turkish exporting companies reduce their apparent external sales prices in Turkey and show their profits in their foreign subsidiaries, thereby reducing their overall tax burden. These intermediary companies can even be established as offshore companies without personnel.

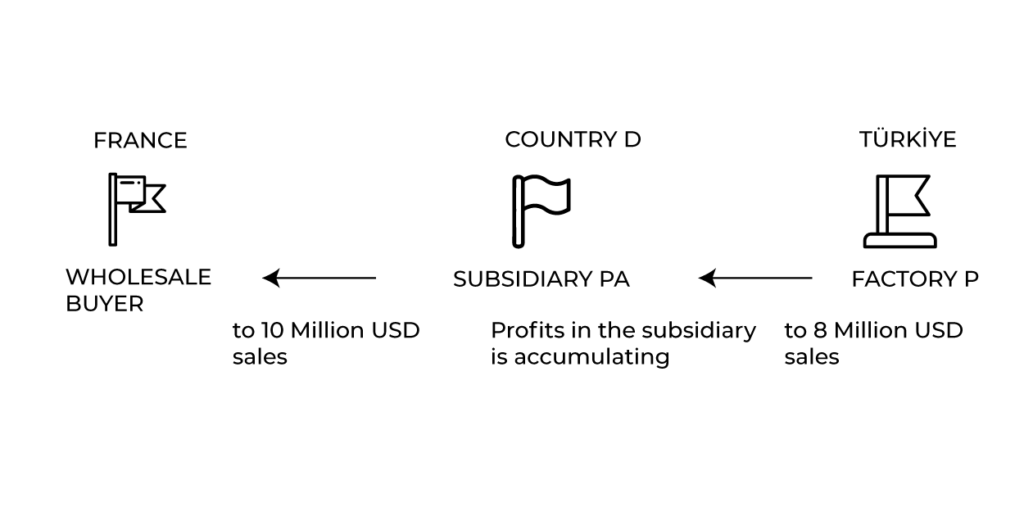

For years, economies like Turkey and the USA have been showing large deficits in their official foreign trade and services balance. This has been ongoing for many years, and no one questions how such large deficits can continue for so long. Some items in foreign payments are already determined based on estimates. Tourism revenue is a prime example of this. However, even if all the foreign exchange inflows and outflows in official records are correct, they may not reflect the real situation. Many companies show different prices in their invoices for international trade in goods and services compared to the final price to the buyer. One reason for this is to reduce their tax expenses: In this context, a factory establishment (P) in a country with high corporate taxes, such as Turkey, sells its product at a lower price (e.g., 8 million USD) to its subsidiary (PA) established in a tax haven (D). The main company PA sells the product at the correct price (e.g., 10 million USD) to the final buyer in France. This way, the profit of the factory establishment (P) in Turkey appears lower, resulting in almost no corporate tax payable, and part of the profit from this export appears in the PA company in country D. In this way, the corporate group minimizes the taxes they pay.

Obtaining Overseas Financing

Exporting companies from Turkey show lower external sales prices in Turkey through an intermediary company established in a country with low corporate taxes. They sell the products to their intermediary company abroad at a lower price and then sell them to the final buyer at the actual price through the intermediary company. By accumulating profits in the intermediary company’s balance sheet and opening accounts in that country’s banks under the intermediary company’s name, they secure loans from foreign banks by demonstrating the intermediary company’s activities through account transactions.

In the previous example, the factory establishment (P) in Turkey sometimes establishes its subsidiary (PA) in country D, which has a strong foreign banking system but lower corporate taxes compared to Turkey, to apply for foreign loans. By doing so, the company tries to secure foreign loans and exports to France through the subsidiary in country D. This also provides significant tax savings. For example, the factory establishment (P) in Turkey sells shirts to its PA subsidiary in country D for 8 million USD instead of 10 million USD. The PA subsidiary in country D sells the shirts to the final buyer in France for 10 million USD. Since the profit of the P company in Turkey appears lower, less tax is accrued there. The profit accumulated in the subsidiary in country D is also taxed at a lower rate. The company owners use most of the profit to reinforce the PA company’s equity, showing it as profitable, and apply for credit in country D. By opening an account in a bank, the company owners gain the bank’s trust over 1-2 years through account transactions, explaining their business activities well and securing bank loans in that country.

Many international companies adjust prices in their intercompany trade of goods and services to show lower profits in high-tax countries like Turkey and higher profits in low-tax countries like D. This way, the profits of the international company accumulate in countries with low corporate taxes. If importers in developed countries purchase goods with deferred payments, the PA subsidiary in country D, where the law is more reliable, can secure loans from banks in D by showing these receivables as collateral. Meanwhile, the following credits can be obtained in Turkey:

- Pre-Export Credits: These credits are provided through commercial banks to support exporters from the production stage. The intermediary bank assumes the company and export risk in these credits.

- Pre-Export Turkish Lira Credit: A short-term credit type used by companies producing export-oriented goods.

- Pre-Export Turkish Lira Credit for Priority Development Areas: A credit type provided to manufacturers, manufacturer-exporters, and exporters conducting economic activities in priority development areas.

- Pre-Export Foreign Exchange Credit: A credit type given against the commitment to export goods for foreign exchange.

- Export Credits for Foreign Trade Companies (FTC): These credits are provided to meet the financing needs related to the exports of Foreign Trade Capital Companies (FTCC) and Sectoral Foreign Trade Companies (SFTC).

- Export Preparation Credits: This program allows exporters to use credit directly from Eximbank without an intermediary bank, supporting export activities at the preparation stage, conducted in foreign exchange or Turkish Lira.

- SME Export Preparation Credits: Companies meeting the SME definition can benefit from this credit under the condition of exporting goods against an export commitment. Besides short-term export credits, there are also special credits and intermediary credits applied by Turkish Eximbank to support exports. Details about these credits can be found on the Eximbank website.